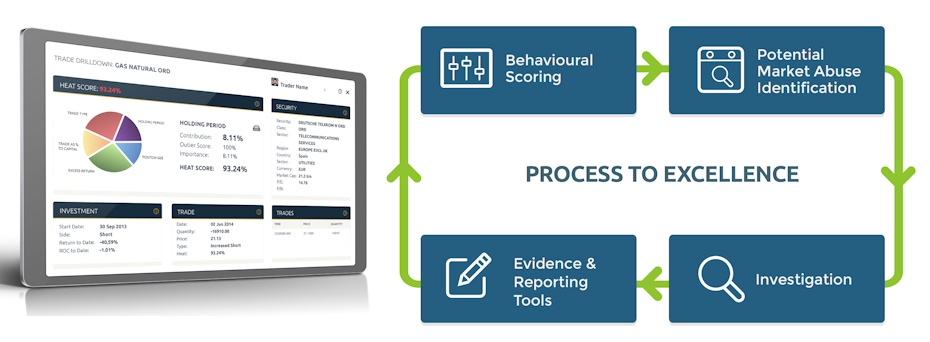

Sybenetix Compass provides compliance teams with the behaviourial profiling algorithms needed to effectively address Market Abuse Regulation (MAR) requirements. The software enables suspicious activities to be flagged more accurately and investigated immediately, transforming trade surveillance management.

Fast Scalable Analytics Engine

Fast Scalable Analytics Engine Behaviour Profiling Algorithms

Behaviour Profiling Algorithms Investment Processing

Investment Processing Market Activity Detection

Market Activity Detection